Latin America's Divergence From Fed Sets Up Win for Local Bonds

4.6 (540) · $ 22.00 · In stock

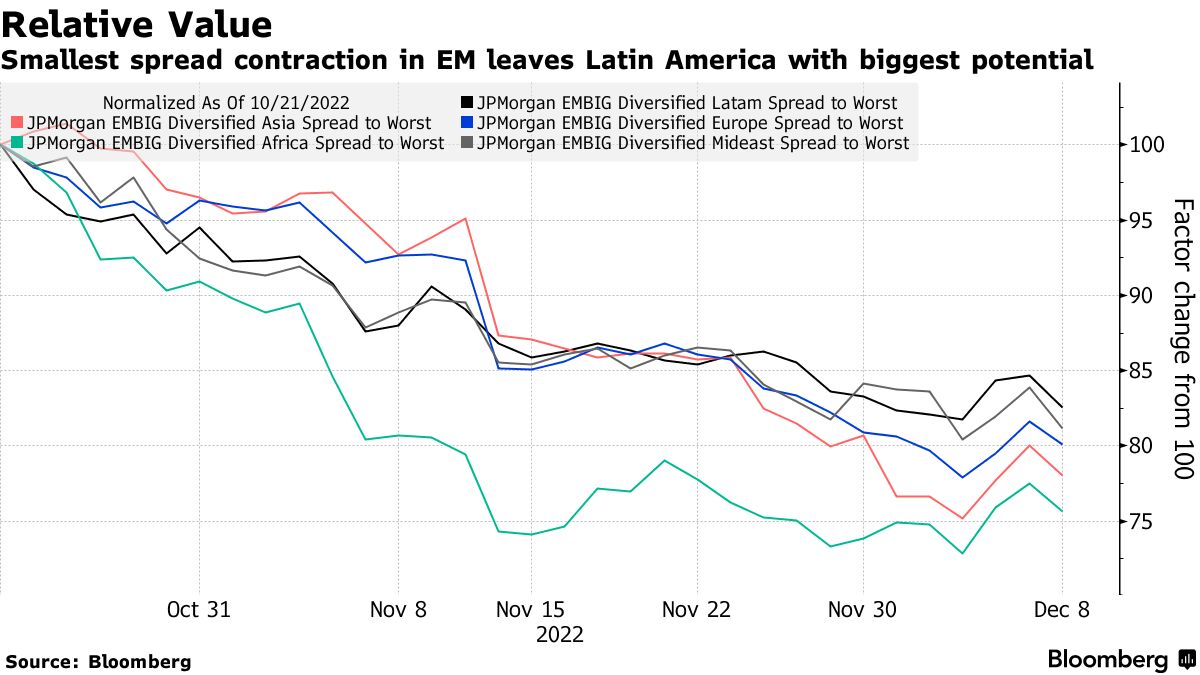

Latin America’s beaten-down local bonds are getting another look from investors who see an opportunity to profit from monetary policies that are out of sync with the developed world.

Spillovers from United States Monetary Policy on Emerging Markets in: IMF Working Papers Volume 2014 Issue 240 (2014)

Four Looming Risks That Could Bolster EM Bonds

PDF) Bi-regional Relations EU-LAC Foundation EU-LAC Multilateralism and Regionalism in Challenging Times: Relations between Europe and Latin America and the Caribbean Multilateralism and Regionalism in Challenging Times: Relations between Europe and Latin

2009 Latin American Business Environment Report - University of Florida by Giancarlo Colombo - Issuu

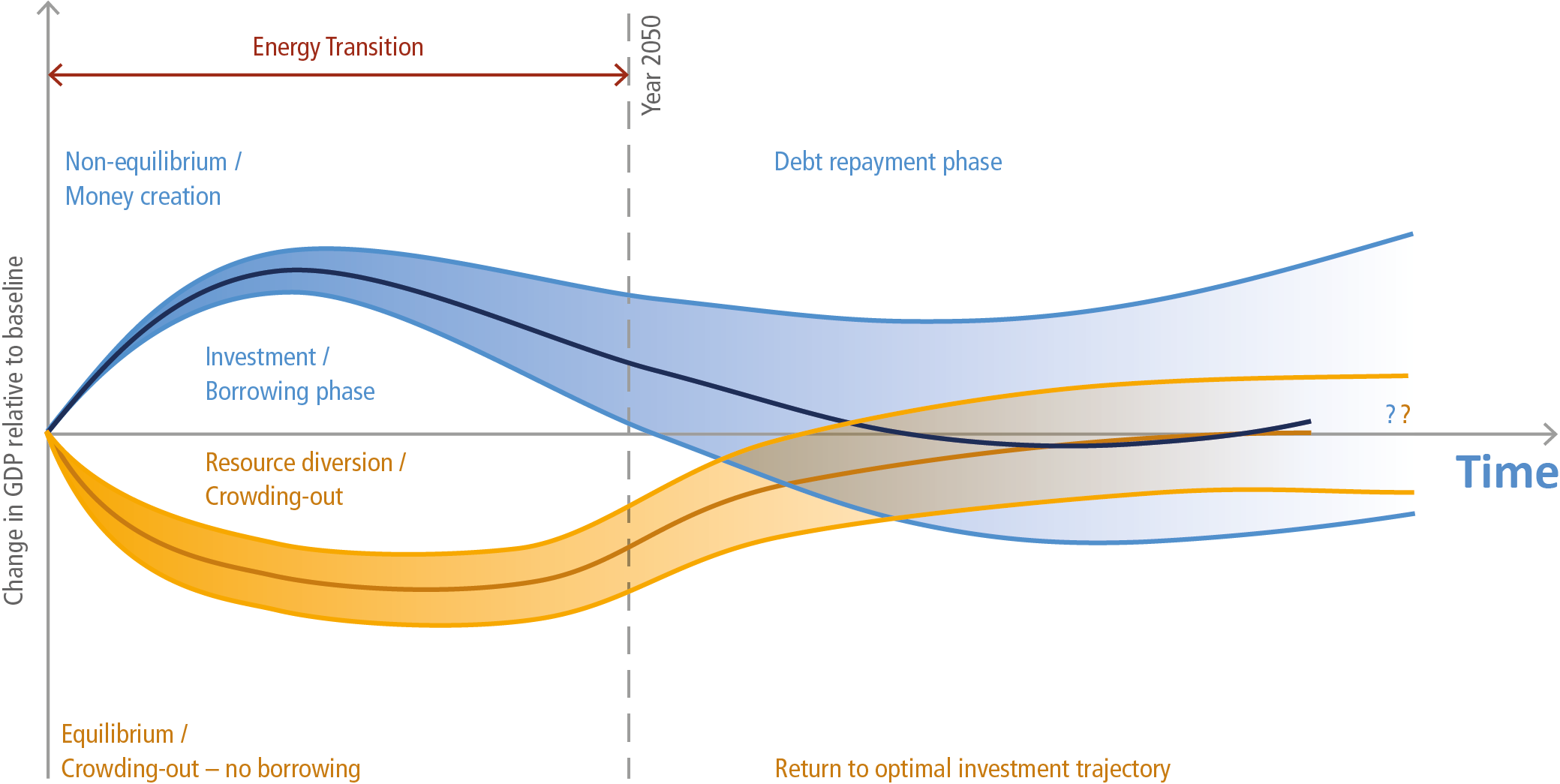

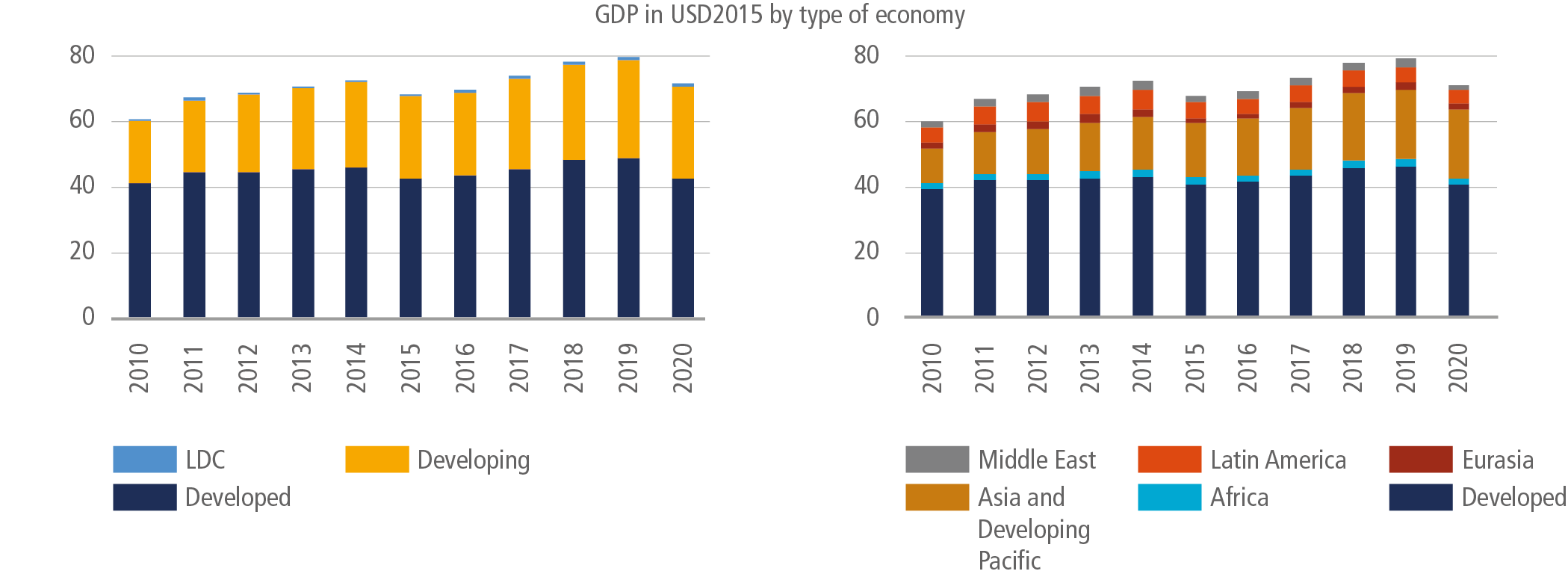

Chapter 15: Investment and finance

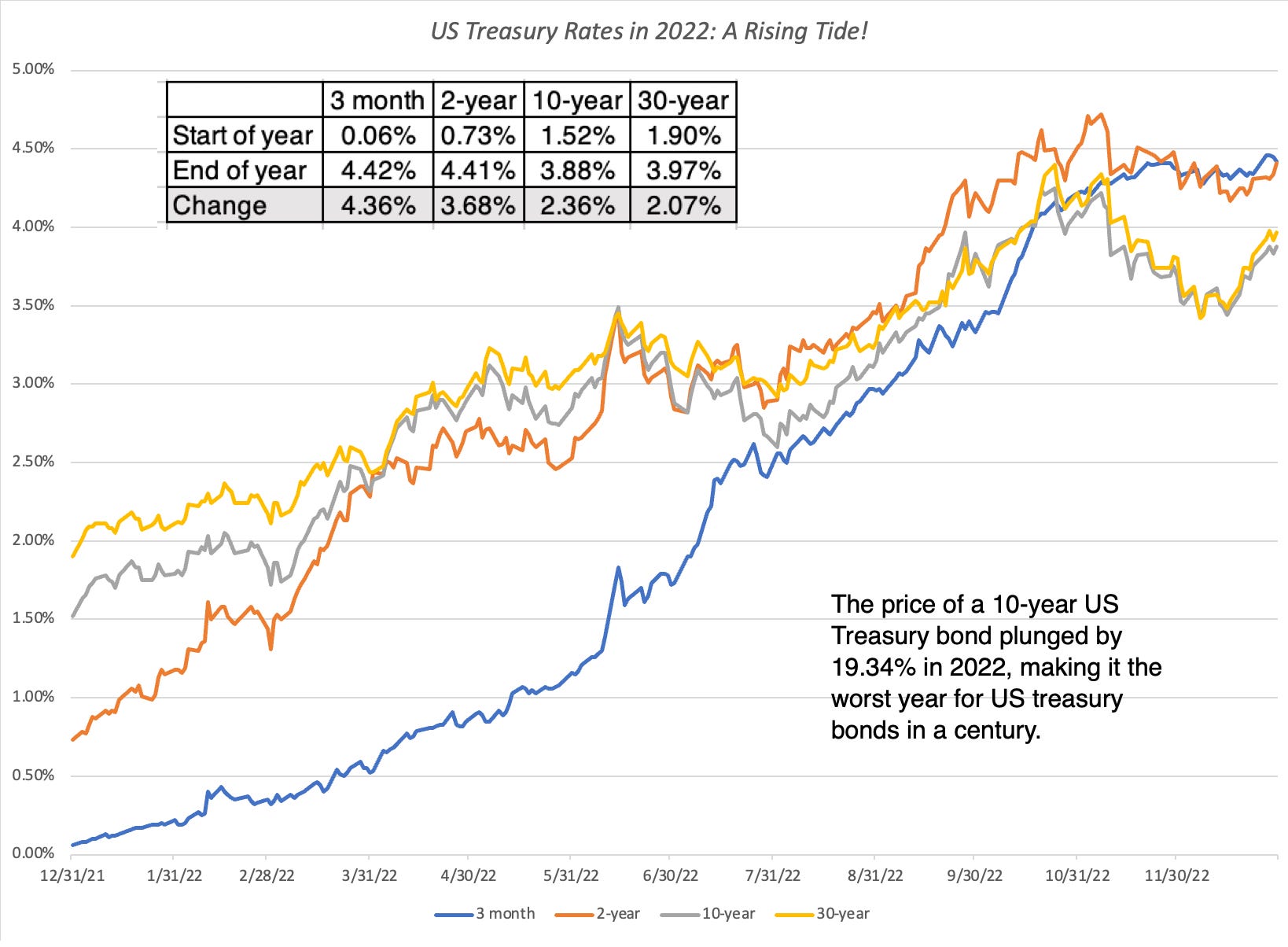

Market Resilience or Investors in Denial: The Market at Mid-Year 2023

Latin America Growth and Opportunities in 2023

Chapter 15: Investment and finance

3. Foreign Exchange Market Intervention: How Good a Defense Against Appreciation Winds? in: Regional Economic Outlook, April 2011, Western Hemisphere

Market Resilience or Investors in Denial: The Market at Mid-year 2023

Market Resilience or Investors in Denial: The Market at Mid-Year 2023

Global Finance from a Latin American Viewpoint by IDB - Issuu

Latin America Debt Set for a Comeback as Politics Give a Break - Bloomberg

Back Matter in: International Capital Markets, August 2001