Tie breaker Rule for an individual in International Taxation

4.6 (353) · $ 9.99 · In stock

Article 4 deals with the provision, where an individual becomes a tax resident of the Country of Source as well as Country of Residence . I.

Tax treaties: Unraveling Double Taxation with International Agreements - FasterCapital

CA Arinjay Jain on LinkedIn: #UAECorporateTax Persons required to

Use of Tie Breaker in Residential Status of NRI's

Residency under Tax Treaty and Tie Breaker Rules

CA Arinjay Jain on LinkedIn: Article 1 Person Covered

International Tax Newsletter

Tax implications on Japanese companies investing into India

CA Arinjay Jain on LinkedIn: #india #taxnews #tds #taxnews

Global Minimum Tax - New World New Tax Concept

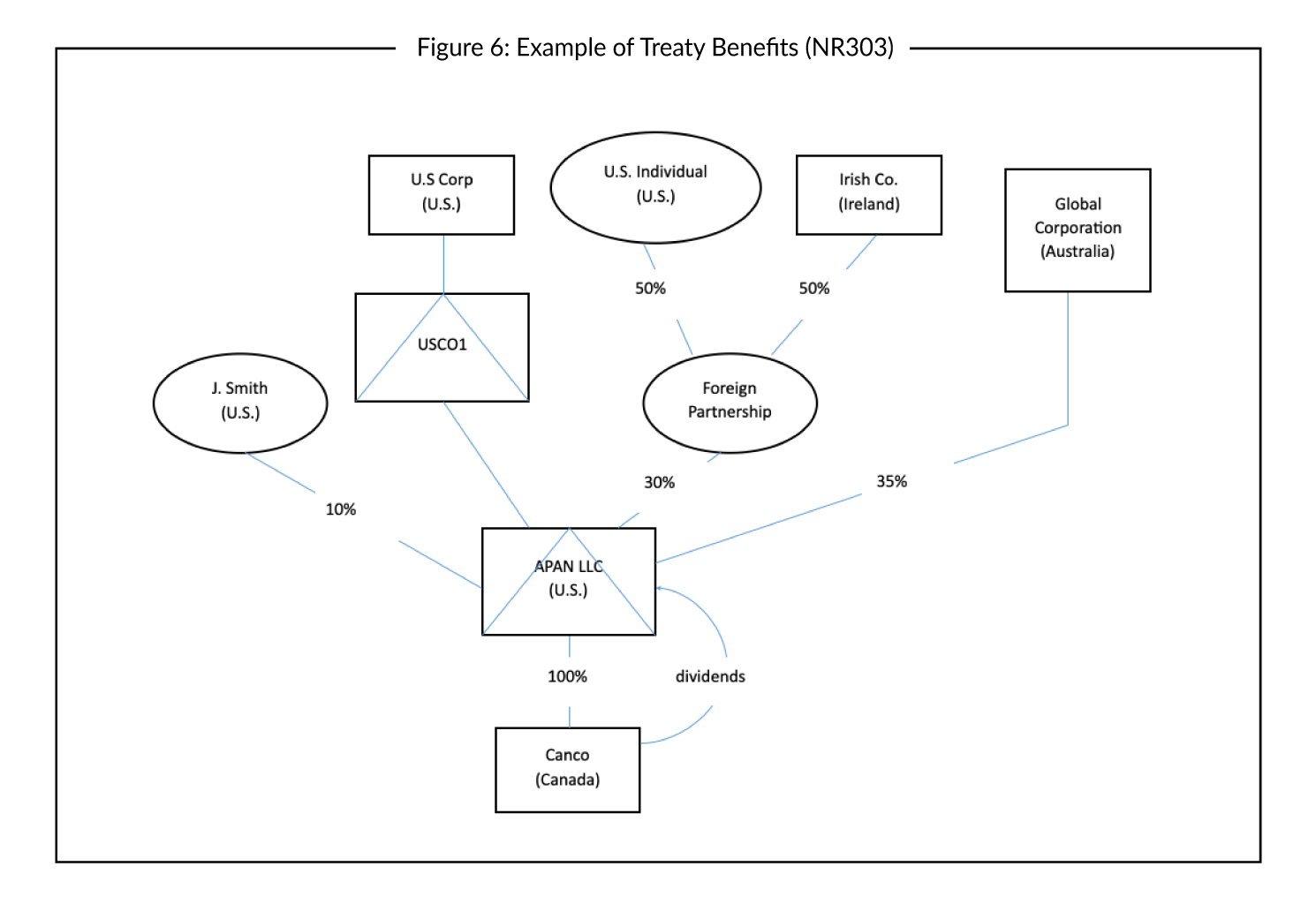

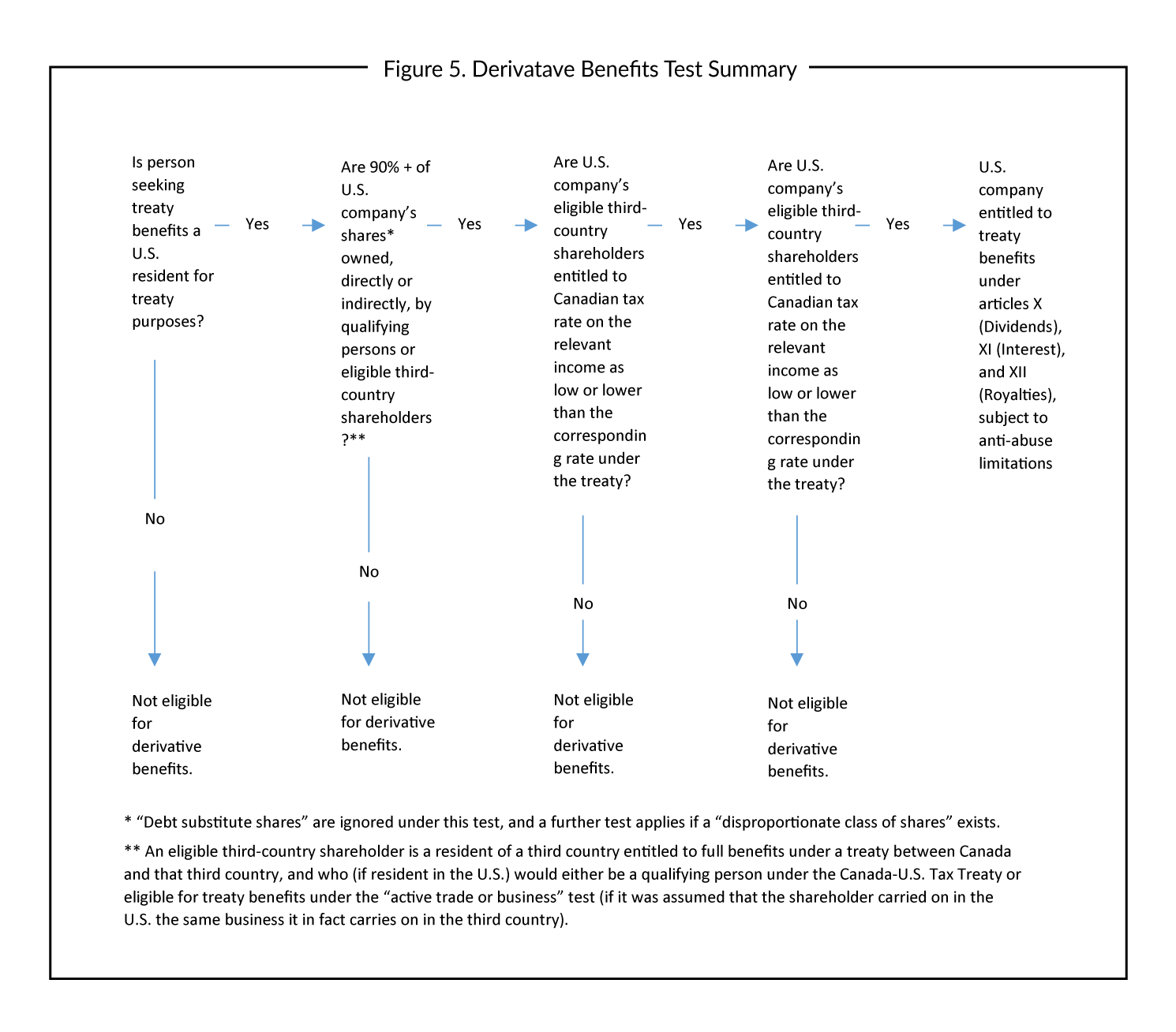

Tax Treaties Business Tax Canada

Tax Treaties Business Tax Canada